Healthcare is moving into a pivotal moment. Rising labor pressure, severe cost constraints, and fast moving patient expectations are forcing hospitals, payers, and health technology companies to rethink how they deliver value. What once felt experimental now feels inevitable. The year 2026 is shaping up to be a turning point where artificial intelligence, next generation data infrastructure, and new clinical models converge into real operational change.

This guide explores the top ten healthcare technology trends for 2026. It draws on recent peer reviewed studies, federal policy updates, vendor reports, and industry data to explain where innovation is actually headed. The goal is to cut through the noise and help leaders understand what matters most.

What To Expect

Healthcare technology trends for 2026 include enterprise scale artificial intelligence, generative AI for documentation and operations, expanded virtual care with home monitoring, digital twin models, modernized cybersecurity through zero trust, faster FHIR based interoperability, advanced precision medicine, surgical and logistics robotics, automation driven workforce support, and cloud native data platforms. These trends improve quality, reduce waste, and increase clinical capacity.

1) Enterprise AI & Clinical Decision Support

Artificial intelligence will shift from scattered pilots to full enterprise adoption in 2026. Several factors are driving this change. Clinical data volumes continue to rise sharply. A recent estimate found that healthcare generates more than 30 percent of the worlds data each year [1]. At the same time, clinician burnout remains high. More than 60 percent of physicians report symptoms of burnout according to a 2023 study in the Journal of the American Medical Association [2]. Health systems are turning to AI to support decision making, reduce variability, and streamline cognitive labor.

AI powered clinical decision support tools are gaining traction in radiology, pharmacy, and cardiology. The United States Food and Drug Administration has cleared over 690 AI enabled medical devices to date, most of them related to medical imaging [3]. Leaders across large health systems are now integrating these tools directly into workflows rather than running them as side projects.

Mini case:

In 2024, Mass General Brigham reported that an AI model for stroke detection reduced door to treatment time by 11 minutes across more than 60 hospitals and urgent care sites [4]. Faster activation directly correlates with reductions in long term disability for stroke patients. This example illustrates how enterprise scale deployment, not isolated experimentation, creates measurable clinical impact.

The challenge for 2026 is not whether AI will be used but how safely and consistently it will be integrated. Leaders must establish model governance, validation protocols, and ongoing monitoring to avoid drift. The systems that can operationalize AI with discipline will capture significant clinical and financial value.

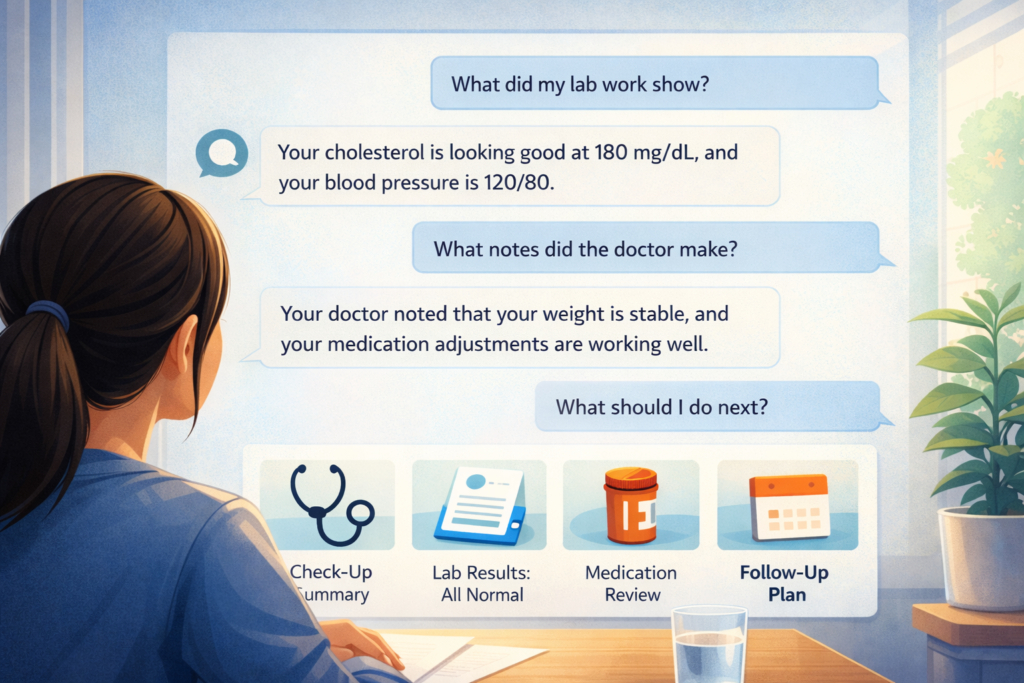

2) Generative AI For Documentation and Operations

Generative AI is reshaping the administrative core of healthcare. EHR vendors, transcription companies, and call center platforms now offer ambient voice capture that listens during patient encounters and produces structured clinical notes. Epic announced in 2024 that more than 230 health systems adopted its generative documentation assistant in under one year [5]. Early internal evaluations show reductions in after hours charting and improved usability scores.

Generative models are also supporting non clinical operations. Many revenue cycle teams use AI to draft appeal letters, surface coding discrepancies, and route prior authorization requests. Payer call centers are adopting conversational models that reduce average handling time and improve first call resolution. While independent verification is still limited, organizations that report outcomes describe reductions in documentation time of 30 percent to 50 percent across selected specialties [5].

Safety remains the primary concern. Generative AI can produce inaccurate statements if prompts lack precision. Regulatory bodies like the Office of the National Coordinator are releasing new guidance on safe use frameworks. In 2026, the institutions that pair generative technology with strong human oversight will see the largest gains.

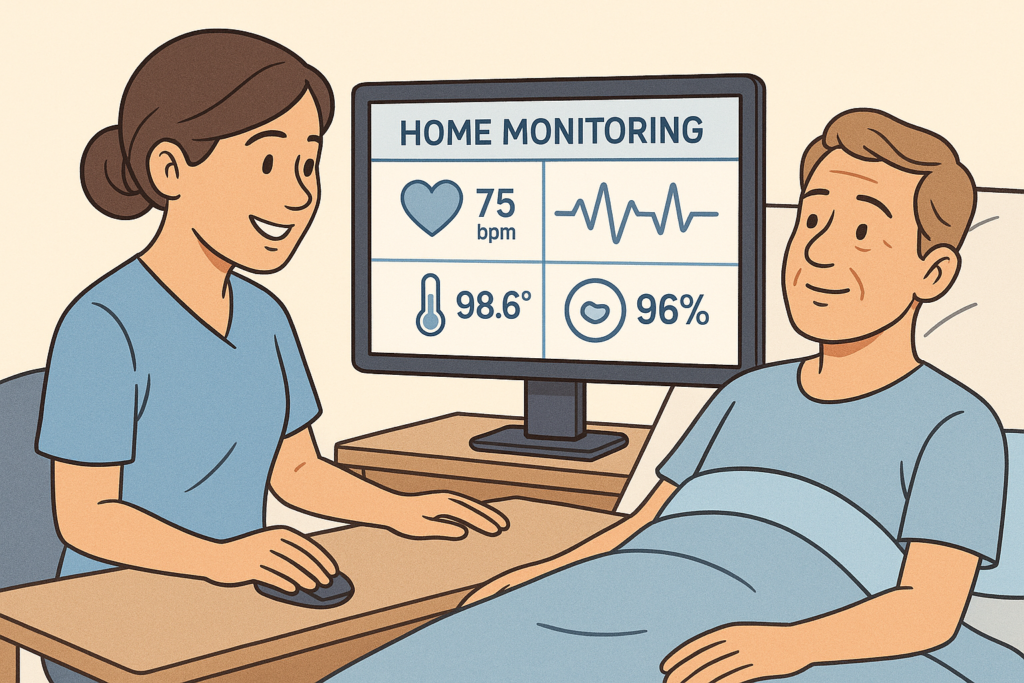

3) Virtual Care Expansion

Virtual care is entering a more mature phase in 2026. Utilization climbed sharply during the pandemic, dipped in 2022, and is now stabilizing at roughly three to four times pre pandemic levels depending on specialty [6]. What is changing is the growth of home based diagnostics and continuous monitoring.

Health systems are deploying kits that include blood pressure cuffs, pulse oximeters, glucose sensors, and weight monitoring devices. These devices send real time data to clinical dashboards. A 2023 Veterans Affairs study found that remote monitoring for heart failure patients reduced hospitalization risk by 19 percent [7].

AI triage systems are improving virtual navigation. Chat based symptom checkers can route patients to the right level of care, reducing unnecessary visits and accelerating responses for complex needs. Payers are integrating these tools into their member portals to lower triage costs.

Decentralized clinical trials are accelerating due to these same trends. Sponsors are using remote data collection and virtual visits to increase recruitment and reduce logistical burdens. The United States Food and Drug Administration has encouraged this movement with recent draft guidance on digital health technologies in clinical research [8].

4) Digital Twins In Care Delivery

Digital twins are virtual replicas of organs, conditions, or entire clinical systems. They simulate how a patient or group of patients might respond to interventions. Research in cardiovascular digital modeling shows promising accuracy when calibrated with real imaging and laboratory data [9].

Biopharma companies are using digital twins to shorten early research timelines. They simulate disease progression, test dosing scenarios, and estimate trial outcomes before real patient enrollment. Some organizations report early cycle R and D time savings between 10 percent and 20 percent, although independent confirmation is limited.

Hospitals are beginning to use operational digital twins to simulate patient flow. By modeling census trends, staffing availability, and operating room capacity, leaders can identify bottlenecks and run what if scenarios to improve throughput. Digital twins are still early, but by 2026 the most forward leaning systems will integrate them into planning cycles.

5) Cybersecurity Modernization

Healthcare continues to be the most targeted sector for ransomware attacks. The United States Department of Health and Human Services reported a 93 percent increase in large breaches involving ransomware from 2021 to 2023 [10]. The financial and patient safety stakes make cybersecurity one of the most urgent priorities for 2026.

Zero trust models are moving from theory to real implementation. Zero trust requires continuous verification of users, devices, and services rather than assuming access based on location. Network segmentation, identity controls, and real time threat intelligence are becoming standard expectations.

Mini case:

In 2023, the University of Vermont Medical Center publicly reported that its ransomware attack disrupted care for more than 40 days and cost over 63 million dollars in recovery and lost revenue [11]. The event accelerated statewide investment in zero trust frameworks and modern endpoint protection. This illustrates how operational resilience is now central to overall patient safety.

AI driven anomaly detection tools are gaining popularity. These systems monitor traffic patterns and surface suspicious behavior faster than traditional rule based tools. Leaders must balance automation with skilled human oversight because false positives can overwhelm security teams.

6) Interoperability Acceleration with FHIR

Interoperability will advance rapidly in 2026 due to regulatory pressure and ecosystem alignment. The United States Office of the National Coordinator has continued to expand the Trusted Exchange Framework and Common Agreement. This program aims to create a nationwide floor for secure data exchange among providers, payers, and technology companies [12].

FHIR is becoming the dominant standard for modern data exchange. Major EHR vendors, insurance companies, and external application developers are building FHIR endpoints that support clinical summaries, medication lists, lab results, prior authorization workflows, and payer to provider reporting.

Predictive analytics solutions rely on clean and consistent FHIR feeds. When systems can access structured data from multiple sources, models that forecast readmission risk, staffing needs, or disease progression become more reliable. Interoperability underpins nearly every other trend in this article.

7) Precision Medicine and Advanced Diagnostics

Precision medicine continues to expand with advances in sequencing, molecular diagnostics, and targeted therapies. The cost of whole genome sequencing has dropped from roughly 1000 dollars in 2022 to approximately 600 dollars in 2024 in many research settings [13]. Cheaper sequencing enables broader population screening and earlier risk detection.

New companion diagnostics help clinicians choose the right therapy for individual tumor profiles or genetic variants. The Oncology Center of Excellence reports that more than 450 drug labels now include biomarker driven indications [14]. By 2026, precision medicine programs that link genomics, imaging, pharmacy data, and outcomes will guide treatment pathways more consistently.

AI amplifies this trend by discovering patterns that are not visible through traditional analysis alone. Researchers at Stanford demonstrated in 2023 that AI supported genomic interpretation increased diagnostic yield for rare diseases by up to 15 percent in selected cohorts [15]. Although results vary by population, the direction is clear.

8) Robotics In Surgery

Robotics are expanding beyond the operating room. Surgical robotics continue to advance in precision for minimally invasive procedures. Intuitive, Medtronic, and several emerging competitors are rolling out next generation systems that provide finer control and better visualization. Studies show that robotic assisted procedures can reduce lengths of stay and complication rates for selected surgeries, although evidence varies by specialty [16].

Hospitals are also adopting logistics robots that move medications, supplies, and linens. These robots reduce manual transport tasks and free clinical staff for higher value work. Global forecasts predict strong growth in hospital robotics markets through 2030, driven by labor shortages and throughput needs [17].

The major barrier is capital cost. However, subscription models and robotics as a service offerings are addressing affordability for medium sized institutions.

9) Automation and Workforce Augmentation

Automation is becoming a strategic response to workforce shortages. Health systems face persistent staffing gaps. The United States Bureau of Labor Statistics projects more than 195000 annual openings for registered nurses through 2032 due to retirements, burnout, and population growth [18].

AI and robotic process automation are filling repetitive tasks such as scheduling, eligibility checks, supply ordering, and data abstraction. Early implementations in large systems show reductions in manual workload between 20 percent and 40 percent for selected workflows according to internal reports from adopters.

The intent is not to replace employees but to focus skilled labor on patient facing and analytic roles. The organizations that design automation with staff input report smoother adoption and better morale.

10) Cloud Native Infrastructure

Cloud native infrastructure is becoming central to modern healthcare. Large payers and health systems are moving analytics and application workloads to cloud environments due to cost efficiency, security controls, and scalability. Public cloud providers offer advanced tools including secure storage, machine learning pipelines, and managed FHIR services.

A 2023 KLAS survey found that more than 60 percent of large provider organizations have active cloud migration plans, with many citing improved disaster recovery and easier data sharing as key drivers [19]. Cloud platforms support the enterprise scale models described earlier in the article. They also allow organizations to combine claims data, EHR data, patient generated data, and imaging archives in unified analytic layers.

The primary challenge is designing permissions, access controls, and data lifecycle rules that align with privacy regulations. The organizations that invest in governance will build durable competitive advantage.

The Ready Set Scale Model For Healthcare Innovation Planning

Healthcare leaders need a simple, operational playbook to evaluate emerging technology. The Ready Set Scale model offers a clear structure.

- Ready

Assess capabilities, data readiness, privacy constraints, and business needs. Identify clinical sponsors and cross functional stakeholders. - Set

Launch a focused pilot. Define a small group of users, success metrics, training plans, and safety checks. Run the pilot for a fixed time window and collect both quantitative and qualitative outcomes. - Scale

If the pilot meets its goals, expand with enterprise guardrails. Standardize workflows, strengthen governance, assign ownership, and monitor performance through dashboards. Integrate the tool into normal budgeting and staffing cycles.

This framework helps organizations avoid fragmented deployments and build long term value.

Quick Conclusion: What Leaders Should Focus On In 2026

Healthcare technology is advancing fast, but the theme for 2026 is disciplined execution. Enterprise scale AI, advanced diagnostics, digital care models, and secure data exchange will dominate strategic conversations. The winners will be the organizations that pair innovation with strong governance and clear measurement.

The central takeaway is simple. Technology will not fix healthcare on its own. The institutions that combine innovation with people, process, and culture will shape the next decade of care delivery.

FAQ

What is driving healthcare technology change in 2026

Rising labor shortages, financial pressure, federal interoperability rules, and rapid AI capability improvements are the major drivers.

Which technologies will have the fastest adoption

Generative AI, remote monitoring, cybersecurity modernization, and cloud based data platforms are expected to scale most quickly.

Are digital twins ready for clinical use

Digital twins are promising but still early. They show validated results in cardiology, drug development, and operational forecasting, but broader adoption requires more evidence.

What is the biggest risk in healthcare AI

The risk is inaccurate or biased output when models are not validated or monitored. Strong governance is essential.

Which organizations benefit most from these trends

Hospitals, payers, research centers, and health technology companies with clear data strategies and cross functional teams benefit the most.

Key Takeaways

- AI is shifting from pilots to enterprise medical workflows

- Virtual care is expanding through continuous home monitoring

- Cybersecurity risk is rising and zero trust is now essential

- Precision medicine and robotics are maturing rapidly

- Cloud native infrastructure underpins every major trend

More Articles on Informessor

How Health Informatics Transforms Patient Outcomes

If you have ever wondered why a correct diagnosis does not always translate into better…

Healthcare Data Quality Framework to Fix Broken Dashboards

If you have ever shipped a dashboard you were proud of, only to watch it…

ChatGPT Health Breakdown: The Most Important Health Product of the Decade?

The next decade of healthcare will not be won by the flashiest sensor or the…

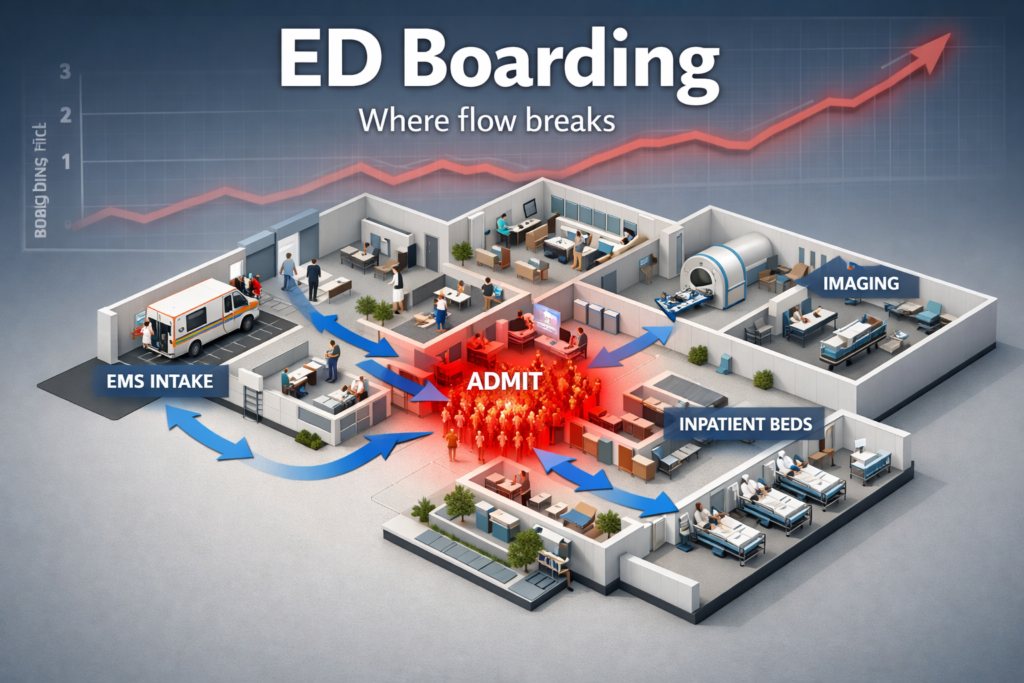

Fixing Emergency Department Delays: How Health Informatics Can Help

Walk into almost any busy emergency department and you will feel it before you measure…

Wellness App or Medical Device? How Wearables Cross The Line

Wearables are no longer just tracking habits. They are shaping decisions. The same sensor that…

AI in Drug Discovery & Clinical Trials: How Far Have We Come?

Artificial intelligence in drug discovery and clinical trials has been sold as a cure for…

References

[1] IDC. The Digital Data Universe Study. https colon slash slash www idc com

[2] Shanafelt T et al. Changes in burnout and satisfaction among US physicians. JAMA 2023.

[3] United States Food and Drug Administration. AI Enabled Medical Devices List. https colon slash slash www fda gov

[4] Mass General Brigham. Stroke AI Evaluation Report 2024.

[5] Epic Systems. Generative Documentation Adoption Report 2024.

[6] McKinsey and Company. Telehealth Trends Report 2023.

[7] Veterans Affairs. Remote Monitoring Heart Failure Analysis 2023.

[8] United States Food and Drug Administration. Digital Health Technologies in Clinical Research Draft Guidance 2023.

[9] European Heart Journal. Computational Models of the Cardiovascular System 2022.

[10] United States Department of Health and Human Services. Ransomware Trends Report 2023.

[11] University of Vermont Medical Center. Ransomware Public Report 2023.

[12] Office of the National Coordinator. TEFCA Framework Update.

[13] National Human Genome Research Institute. Sequencing Cost Data 2024.

[14] United States Food and Drug Administration Oncology Center of Excellence. Biomarker Indications Report 2024.

[15] Stanford Center for Genomics. AI Rare Disease Interpretation Study 2023.

[16] Journal of Robotic Surgery. Review of Robotic Assisted Procedures 2023.

[17] Global Market Insights. Hospital Robotics Market Forecast 2024.

[18] United States Bureau of Labor Statistics. Registered Nurse Outlook 2023.

[19] KLAS Research. Cloud Adoption in Healthcare 2023.